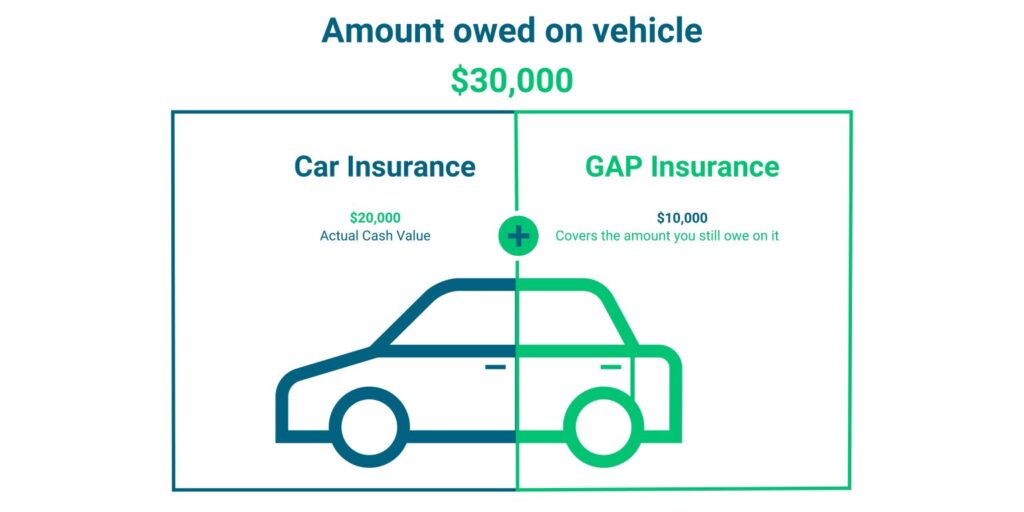

Buying a new or used car is exciting — until you realise how fast it loses value the moment you drive off the lot. In fact, most cars drop 20-30% in the first year alone. If your vehicle gets totalled in an accident or stolen, your regular car insurance only pays the current market value, not what you still owe on the loan. That’s where gap insurance steps in. Also known as Guaranteed Asset Protection, it covers the “gap” between what your insurer pays and the remaining balance on your auto loan or lease.

So, is gap insurance worth it in 2025? Let’s break it down step by step with real numbers, honest pros and cons, and the latest costs — no dealership pressure included.

How Gap Insurance Works (With a Simple Example)

Imagine you just bought a $35,000 SUV. You put down $5,000 and financed $30,000 over 72 months. Six months later, someone runs a red light and your car is declared a total loss. At that point, the car’s actual cash value (ACV) is only $26,000 because of rapid depreciation.

- Your comprehensive and collision coverage pays: $26,000 (minus your deductible, say $500)

- You still owe the bank: $28,500

- You’re suddenly on the hook for: $3,000+ out of pocket

With gap coverage, the gap insurance policy pays that $3,000 difference directly to the lender. You walk away owing nothing. Simple, right?

Watch this quick 3-minute explanation from consumer advocate Clark Howard (highly recommended): What is Gap Insurance? (YouTube Video)

When Gap Insurance Is Worth It (And When It’s Probably Not)

Not everyone needs gap insurance. Here’s a clear breakdown:

You Probably Need Gap Insurance If:

- You put down less than 20-25% when buying

- You took a loan longer than 60 months

- You’re leasing a vehicle (most leases require it)

- You rolled negative equity from a previous car into the new loan

- You bought a vehicle that depreciates fast (many luxury brands, EVs, or pickup trucks)

You Can Probably Skip Gap Insurance If:

- You made a large down payment (30%+)

- You paid cash or have a short loan term

- Your car is already worth more than you owe (positive equity)

- You drive a slow-depreciating model (some Hondas and Toyotas hold value extremely well)

In 2025, new electric vehicles are depreciating even faster than before — some models lose 50%+ in the first 12-18 months — making gap coverage almost essential for many EV buyers.

Gap Insurance Cost in 2025: How Much Should You Actually Pay?

Price varies wildly depending on where you buy it:

| Source | Typical Cost | Notes |

|---|---|---|

| Your auto insurance company | $15–$50 per year | Cheapest and easiest to claim |

| Standalone gap provider | $100–$300 one-time fee | Good middle ground |

| Credit union | $200–$400 (often one-time) | Members usually get the best rates |

| Car dealership / finance office | $600–$1,200 (rolled into loan) | Most expensive — avoid if possible |

Pro tip: Adding loan/lease payoff coverage (the new name many insurers use for gap) to your existing policy usually costs less than one tank of gas per month.

Where to Buy Gap Insurance – Best Options Ranked for 2025

- Your current auto insurer – Fastest claims, lowest price, no extra paperwork

- Online gap insurance providers – Great if your insurer doesn’t offer it

- Credit unions – Often the cheapest one-time fee

- Dealership – Convenient but almost never the best deal

Never feel pressured to sign for dealership gap insurance on the spot. You can almost always add it later — usually within 30–90 days of purchase.

Gap Insurance vs Loan/Lease Payoff Coverage – What’s the Difference?

Many people search “gap insurance vs loan lease payoff” because the names are now used interchangeably. In reality:

- Traditional gap insurance (sold by dealerships) usually has no limit or a very high one

- Loan/lease payoff coverage (from insurance companies) is usually capped at 25% of the vehicle’s value

Both do the same job in 95% of cases, but always read the fine print.

For the official definition, here’s the Wikipedia page on Guaranteed Asset Protection insurance.

How to Get a Gap Insurance Refund If You Pay Off Early

Good news — most gap policies are refundable on a pro-rata basis if you pay off your loan early, trade in, or refinance.

Steps to get your money back:

- Pay off or refinance the vehicle

- Call the gap provider (dealership, insurer, or third party)

- Request cancellation in writing

- Receive refund check (usually within 4-6 weeks)

People regularly get $300–$800 back this way.

Common Gap Insurance Myths Debunked

- Myth: “Full coverage already includes the gap” → No, it only pays actual cash value

- Myth: “Gap insurance is required by law” → Only required on some leases

- Myth: “You can only buy it at the dealership” → Completely false

- Myth: “It covers stolen personal items too” → Nope, that’s comprehensive

Gap Insurance FAQs (2025 Edition)

Q: Is gap insurance worth it for used cars? A: Sometimes. If you financed a 2-3 year old car with little down and a long term, yes.

Q: Can I add gap insurance after buying the car? A: Yes — most insurers let you add within 12-24 months (some up to 36 months).

Q: Does gap insurance cover negative equity from a previous loan? A: Dealership gap usually does. Insurance company loan/lease payoff usually does NOT.

Q: What if my car is totaled without gap insurance? A: You pay the difference out of pocket — and the lender can still come after you for it.

Bottom Line – Should You Get Gap Insurance in 2025?

Ask yourself these three quick questions:

- Did I put down less than 25%?

- Is my loan term longer than 60 months?

- Did I buy a vehicle that depreciates quickly?

If you answered “yes” to two or more, get gap insurance — preferably from your insurer or credit union, not the dealership.

With cars (especially EVs) losing value faster than ever in 2025, gap coverage isn’t just smart — for many buyers, it’s practically mandatory peace of mind.