Have you ever wondered why some brands seem to click with people these days? It’s not the flashy TV spots or banner ads anymore—it’s those relatable folks on social media sharing their real lives, sprinkled with a bit of product magic. In the United Kingdom, influencer marketing has grown into a massive industry, blending creativity with cold, hard data to drive sales and build loyalty. As we wrap up 2025, it’s clear this isn’t just a fad; it’s a core strategy for UK businesses navigating a post-pandemic world full of sceptical shoppers. If you’re a marketer in London or a small business owner in Manchester, these United Kingdom (UK) brand influencer marketing statistics for 2025 offer a peek into what’s working and why.

We’ll dig into everything from skyrocketing budgets to consumer trust, all backed by the freshest insights. Think of it as your cheat sheet to staying competitive in Europe’s hottest market. By the end, you’ll see how UK brands are pivoting toward smarter, more accountable campaigns that deliver real results. Let’s get into it.

I. Introduction

Let’s face it, the UK has always punched above its weight in creative industries, and influencer marketing is no exception. Here in Britain, it’s evolved from casual endorsements to a sophisticated tool that’s reshaping how brands connect with audiences. Why’s 2025 such a big deal? Well, with economic pressures easing a tad and social platforms maturing, UK marketers are focusing on authenticity over spectacle.

Hook yourself on this: Projected spend hits £1.31 billion this year, a solid 17% uptick from 2024, while 84% of UK brands are now knee-deep in influencer partnerships. That’s Europe-leading stuff, folks. Our take? This year marks a turning point: From chasing viral hits to building ROIL-driven, micro-focused, and super-regulated strategies that play by the rules while packing a punch. It’s about trust in a time when consumers demand it.

II. UK Influencer Marketing Market Size & Growth 2025

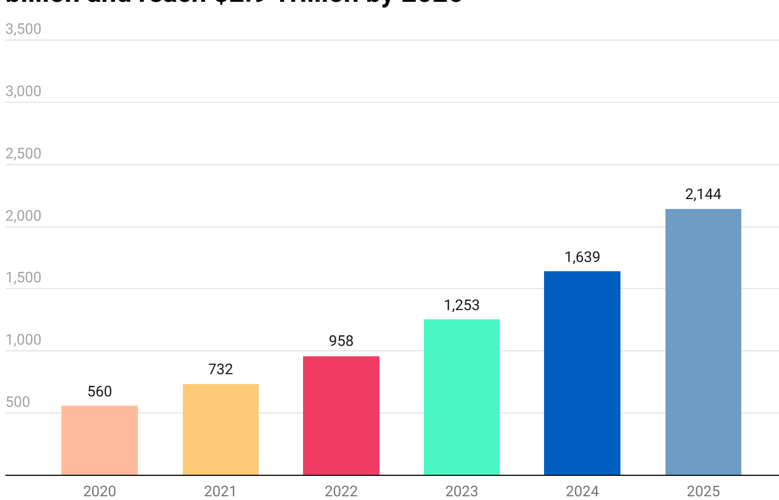

The numbers don’t lie—United Kingdom (UK) brand influencer marketing statistics for 2025 show a market that’s not just growing; it’s accelerating. Total spend lands at £1.31 billion GAP, climbing 17% year-over-year from £1.12 billion in 2024. That’s brands like ASPS and Unilever funnelling more cash into creators who can turn scrolls into sales.

Peering ahead, forecasts peg the market at £2.04 billion by 2029, chugging along at an 11.7% CAR. The UK commands 28-30% of Europe’s entire influencer scene, outpacing neighbours like Germany and France, thanks to our bilingual edge and diverse creator pool. What’s the feeling this? A mix of social commerce boom and post-Brexit innovation, where local brands leverage platforms to reach global audiences without the hassle.

III. Brand Adoption & Budget Allocation

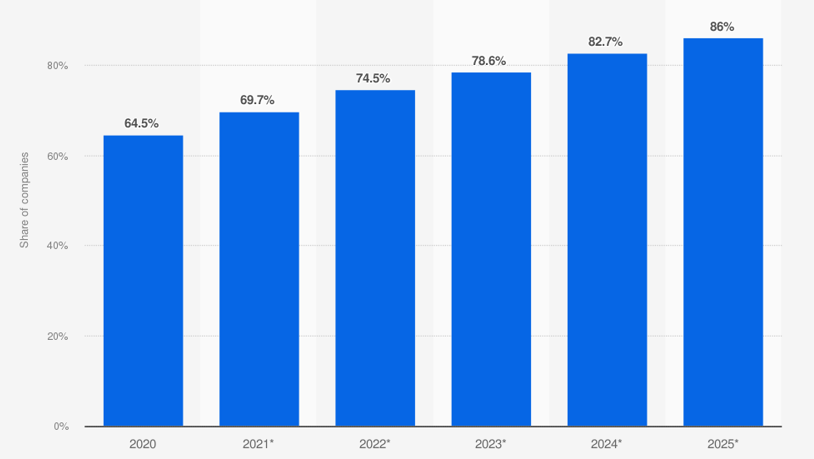

Adoption in the UK is through the roof—84% of companies here tapped influencers between 2024 and 2025, the highest rate in Europe. From high-street retailers in Birmingham to tech startups in Edinburgh, it’s become as essential as SO or email blasts.

Budgets are following suit: 67% of UK marketers plan to increase their influencer spends this year, prioritising it over traditional channels. On average, 16-21% of digital marketing budgets now go to influencers, a 9% increase from last year. Why the shift? Proven results in a tough economy—brands are ditching scattershot ads for targeted collars that feel personal. It’s pragmatic marketing at its best.

IV. Platform Landscape in the UK 2025

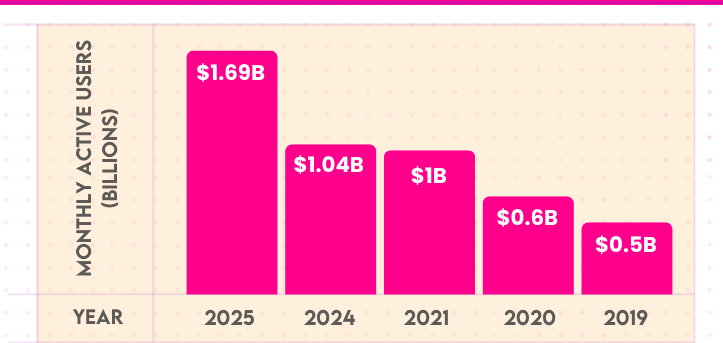

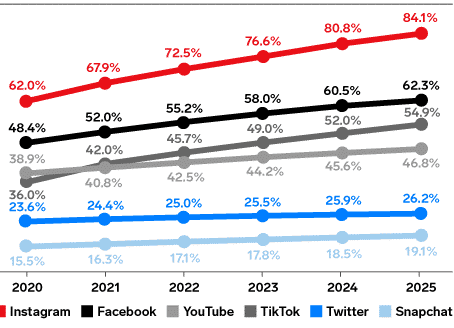

Platforms make or break campaigns, and in the UK, it’s a dynamic mix. Instagram holds court with 68% of campaigns, with visual flair perfect for lifestyle and fashion pushes. But Ticktock’s the speed demon, with 34% Yon spend growth as short-form videos capture younger crowds.

YouTube snags 29% of the pot, excelling in deep dives like beauty tutorials and tech unboxing videos. Emerging stars? Interest surges 41% You for inspirational content, while Twitch and LinkedIn carve niches in gaming and BUB. UK brands are going multichannel, syncing Instagram Stories with TikTok trends. The key? Adapt to algorithm changes and user habits for that sweet spot.

V. Influencer Tier Breakdown

Forget the A-glisters; 2025’s United Kingdom (UK) brand influencer marketing statistics highlight the rise of the little guys. Nano and micro-influencers (1-100 followers) dominate 71% of partnerships, delivering engagement rates of 4.1-8.9% that blow bigger names out of the water.

They’re the go-to for niche targeting—imagine a Manchester mum blogger boosting Eco-products to parents. Macro and celebrity deals? They’ve dipped to just 9%, as brands realise authenticity trumps follower count. It’s a smarter play: Micros offer better value, fostering genuine connections in a market wary of over-polished promos.

Check out the United State (USA) influencer marketing stats for 2025 here

VI. ROIL & Cost Statistics 2025

ROIL is where the rubber meets the road, and UK stats are glowing: Brands see £6.20 in earned media for every £1 spent, topping Europe’s averages. That’s efficiency that keeps CF Os happy.

Costs break down like this: Nano posts at £80-450, micros £500-3,500, macros £8 and up. Top sectors? Beauty and skincare lead with 31% of spend, fashion at 24%, food and drink 18%—categories where visual endorsements shine. Engagement often hits 2-4 traditional ads, proving influencers aren’t just buzz; they’re business boosters.

VII. UK Consumer Behaviour & Trust

Brits are savvy shoppers, but influencers cut through: 63% have snagged a product based on a creator’s nod, the highest in the EU. For 18-34-year-olds, 52% trust them as much as mates or family.

A solid 74% follow at least one influencer daily, seeking inspiration in everything from travel to tech. It’s a trust thing—post-ad fatigue, consumers crave real opinions. This drives social commerce, with endorsements sparking impulse buys across demographics.

VIII. Top Trends Shaping UK Influencer Marketing 2025

Trends are shifting gears: ASS and CAM rules mean 94% of posts now flaunt #ad or #gifted, keeping things transparent. Affiliate deals rule 48% of campaigns, tying pay to performance.

AI’s big too—71% of agencies use it for creator matching. Live shopping explodes, pushing UK social commerce to £11.8 billion. For more on this, peep this YouTube div: Influencer Marketing Trends 2025: UK Edition Insights. It’s a quick watch with real examples.

IX. Challenges for UK Brands

Challenges persist: 49% struggle with ROIL proof, 41% question authenticity, 37% fret over compliance.

22% have nixed mega-deals for poor value. Algorithm tweaks and fake followers add headaches, but tools like AI audits are helping brands navigate.

X. Future Outlook 2026–2030

Looking forward, the UK market is expected to reach £2.5 billion by 2030. Virtual influencers could grab 10% share by 2028, blending AI with creativity. Expect tighter ergs but bigger innovation in the metaverse and AR.

XI. Conclusion & 2025 Action Plan

Summing up the United Kingdom (UK) brand influencer marketing statistics for 2025: £1.31 spend, 84% adoption, £6.20 ROIL—it’s a powerhouse. Key takeaways? Micros rule, AI enhances, transparency wins.

Your plan:

1) Embrace micro-creators for engagement. 2) Dive into affiliate models. 3) Focus on Instagram and TikTok. 4) Always disclose. Get cracking—2026 waits for no one.