Mexico’s digital world is buzzing with energy these days. With more than 110 million people online and folks spending hours scrolling through social feeds, influencer marketing has become a real game-changer for brands. In 2024, the industry here hit around $308 million in ad spend, and experts predict steady growth, thanks to a solid 10.86% compound annual rate through 2029, potentially reaching over $515 million by then.

YouTube continues to be a powerful platform for in-depth content like reviews and tutorials. While Facebook is still valued for its wide audience reach. To maximise impact, many brands strategically combine these platforms for the best overall results.

For a broader look at how influencers work globally, check out the Wikipedia page on Influencer Marketing. It gives a nice overview of the concept’s evolution.

Market Overview and Growth Projections

Mexico’s influencer marketing space is growing steadily, driven by a rising middle class and increasing comfort with digital platforms. Current spending stands at approximately $308 million, with brands investing around $2.80 per internet user in influencer campaigns.

Looking ahead, a projected 10.86% growth rate suggests the market could reach nearly $516 million by the end of the decade. Influencer discovery and management platforms are also expanding rapidly, with 23.9% annual growth rate expected through 2030.

Mexico holds a significant position in Latin America, accounting for about one-quarter of the regional market. As the second-largest market after Brazil, it continues to attract brands as digital tools evolve and adoption increases. This growth goes beyond numbers—it reflects a clear shift toward authentic recommendations that consumers trust more than traditional, flashy advertising.

Consumer Behaviour and Engagement Statistics

Mexicans really engage with creators. Nearly everyone online—97%—follows at least one influencer or content maker. And it’s not passive; 66% have made purchases based on what they’ve seen recommended.

Trust plays a huge part. Around 64% say they prefer influencer content to regular advertising. Younger folks, especially those 18-29. Glued to their screens for over seven hours daily. making them prime for these organic endorsements.

Interestingly, overall trust in big influencers is around 37%, but it jumps to over 63% for the 16-24 age group. This points to a preference for honesty.

Top Platforms and Influencer Types

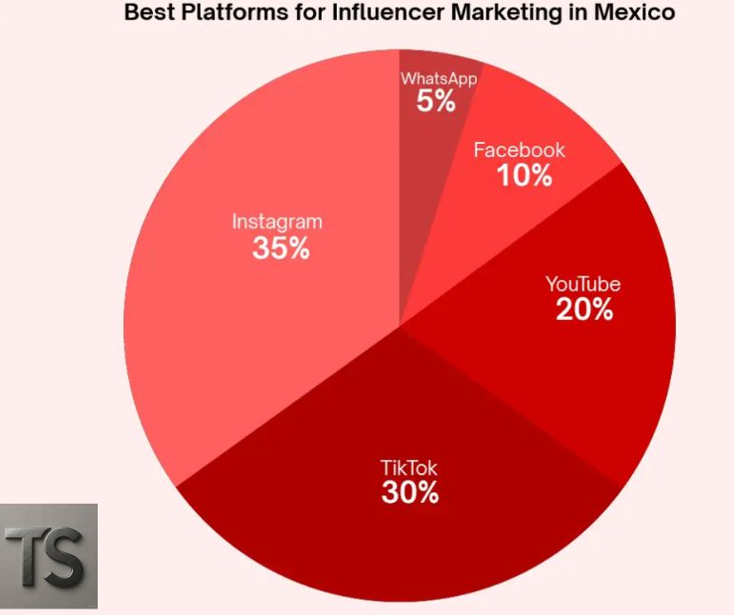

When it comes to platforms, Instagram leads the pack for brand campaigns, perfect for visuals and stories. TikTok is surging with its high engagement—around 7.3% in the region—and quick, fun videos that go viral easily.

YouTube remains a strong platform for in-depth content such as reviews and tutorials, while Facebook continues to be valued for its broad audience reach. Many brands combine these platforms to achieve the best overall results.

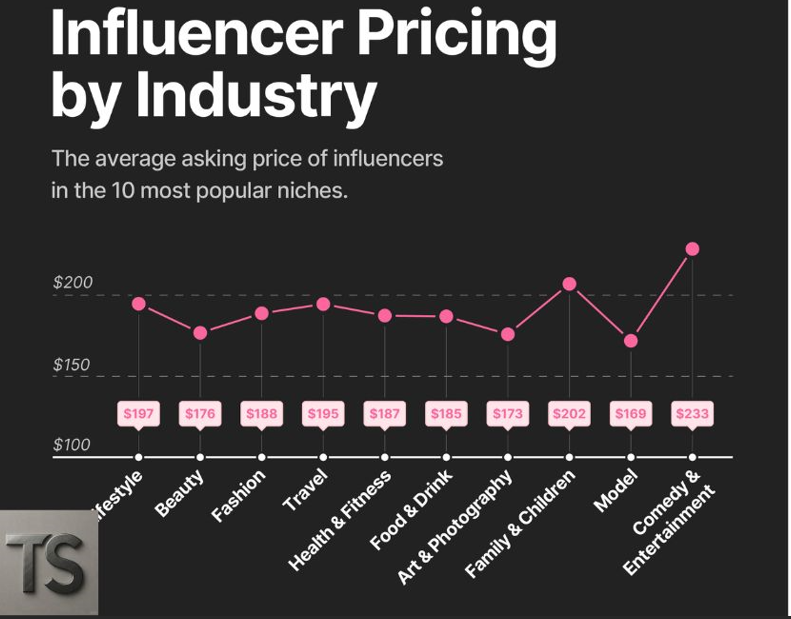

On the creator side, there’s a clear move toward micro and nano-influencers. They offer higher authenticity and engagement, often outperforming mega stars. Popular niches include film and TV, fashion, beauty, food, travel, and entertainment.

Standouts like Kim Liza and Dana Paula dominate on Instagram and TikTok, blending music, lifestyle, and relatable vibes.

How influencers create compelling content, watch this insightful YouTube video on successful strategies: Influencer Marketing Trends in Latin America (note: search for recent uploads on “tendencies influencer marketing Mexico 2025” for fresh examples).

Brand Strategies and ROI Metrics

Brands in Mexico are getting, focusing on full-funnel approaches—from building awareness to driving sales. Many stick with flat fees for collaborations. Affiliate models are gaining ground in memorability.

Sectors like beauty, fashion, and consumer goods are the way. The push for authenticity means partnering with creators who align culturally.

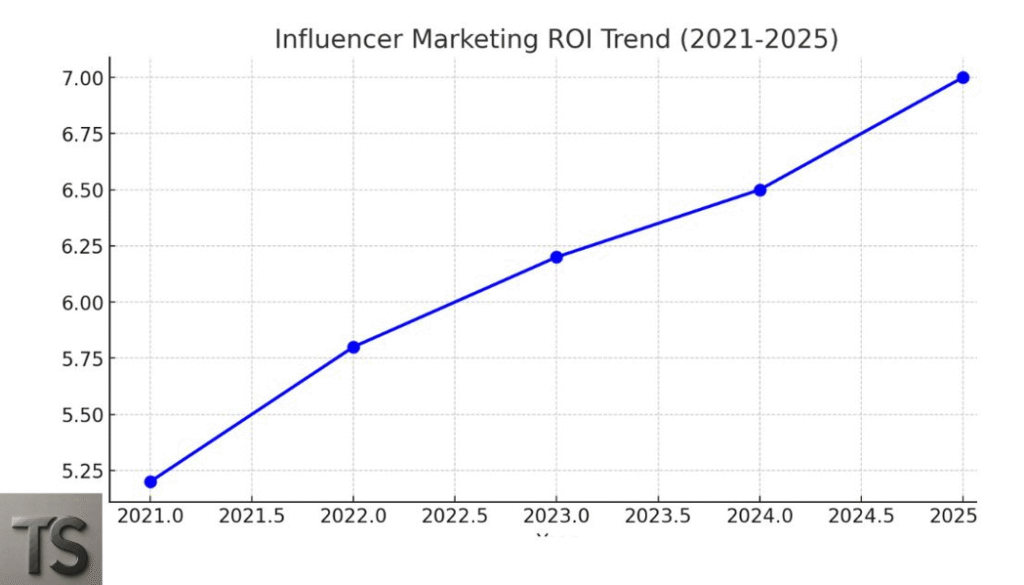

ROI looks promising when done right. Multi-platform efforts, especially combining Instagram, TikTok, and YouTube, tend to yield the strongest outcomes.

Emerging Trends for 2025

This year, authenticity is everything. There’s a rise in “de-influence,” where people prefer everyday user reviews (77% in some surveys) over hype from big names. Micro and nano-creators are thriving because they feel more genuine.

Challenges include platform changes and crowded spaces, but opportunities abound in social commerce and experiential campaigns. Sustainability and cultural relevance are big focuses as consumers demand more meaningful connections.

Conclusion

Mexico’s influencer marketing scene in 2025 is all about growth. With high follow rates, strong purchase influence, and evolving trends toward smaller, authentic creators, it’s a prime spot for brands to build lasting bonds.

The key? Prioritise data-backed choices, cultural fit, and measurable results. Agencies like Brand Me or The Influencer Marketing Factory can help navigate this dynamic landscape.

Looking ahead, as part of Latin America’s second-largest market, Mexico continues to innovate in mobile-first, youth-driven ways. Brands that embrace these insights will likely see the best returns

Check out the United State (USA) influencer marketing stats for 2025 here.

Mexico Brand Influencer Marketing Statistics 2025: Key Insights and Trends

Introduction

Mexico’s digital world is buzzing with energy these days. With more than 110 million people online and folks spending hours scrolling through social feeds, influencer marketing has become a real game-changer for brands. In 2024, the industry here hit around $308 million in ad spend, and experts predict steady growth, thanks to a solid 10.86% compound annual rate through 2029, potentially reaching over $515 million by then.

What makes this exciting is how many Mexicans trust influencers. A huge 97% of internet users follow at least one creator, and 66% have actually because of a recommendation from them. That’s way more impact than traditional ads for many, especially the younger crowd who log in around 7-8 hours a day on social platforms.

This year, 2025, brands are leaning into real, relatable partnerships, especially with smaller creators who feel like friends rather than celebrities. It’s all about building genuine connections in a market that’s part of Latin America’s vibrant scene. If you’re a brand looking to connect authentically, understanding these shifts is key.

For a broader look at how influencers work globally, check out the Wikipedia page on Influencer Marketing. It gives a nice overview of the concept’s evolution.

Market Overview and Growth Projections

Mexico’s influencer marketing space is experiencing steady growth, fueled by a rising middle class and increasing comfort with digital platforms. Currently, spending stands at approximately $308 million, with brands investing around $2.80 per internet user in influencer campaigns.

Looking ahead, a projected 10.86% growth rate indicates the market could reach nearly $516 million by the end of the decade. Platforms that support influencer discovery and campaign management are also expanding rapidly, with an impressive 23.9% annual growth rate expected through 2030.

Mexico plays a key role in the Latin American market, accounting for about one-quarter of the regional share. As the second-largest market after Brazil, it continues to attract more brands as digital tools evolve. This growth is not just about numbers—it reflects a clear consumer preference for authentic recommendations over traditional, flashy advertising.

Consumer Behaviour and Engagement Statistics

Mexicans really engage with creators. Nearly everyone online—97%—follows at least one influencer or content maker. And it’s not passive; 66% have made purchases based on what they’ve seen recommended.

Trust plays a crucial role, with around 64% of consumers saying they prefer influencer content over traditional advertising. Younger audiences—particularly those aged 18–29—spend more than seven hours a day on their screens, making them especially receptive to authentic, influencer-driven endorsements.

for over seven hours daily, making them prime for these organic endorsements.

Interestingly, overall trust in major influencers stands at around 37%, but it rises to over 63% among the 16–24 age group. This highlights a clear preference for honest, relatable reviews over highly polished promotional content.

Top Platforms and Influencer Types

When it comes to platforms, Instagram leads brand campaigns thanks to its strong visual appeal and storytelling features. TikTok is rapidly gaining momentum, driven by high engagement rates—around 7.3% in the region—and short, entertaining videos that easily go viral.

YouTube remains a powerful platform for in-depth content such as product reviews and tutorials, while Facebook continues to be valued for its broad audience reach. To maximise impact, many brands strategically combine these platforms for the best overall results.

On the creator side, there’s a clear move toward micro and nano-influencers. They offer higher authenticity and engagement, often outperforming mega stars. Popular niches include film and TV, fashion, beauty, food, travel, and entertainment.

Standouts like Kim Liza and Dana Paula dominate on Instagram and TikTok, blending music, lifestyle, and relatable vibes.

How influencers create compelling content, watch this insightful YouTube video on successful strategies: Influencer Marketing Trends in Latin America (note: search for recent uploads on “tendencies influencer marketing Mexico 2025” for fresh examples).

Brand Strategies and ROI Metrics

Brands in Mexico are getting smarter focusing on full-funnel approaches—from building awareness to driving sales. Many stick with flat fees for collaborations, but affiliate models are gaining ground better memorability.

Sectors such as beauty, fashion, and consumer goods lead the way. The push for authenticity means partnering with creators who align culturally.

ROI looks promising when right, with trusted endorsements leading to conversions. Multi-platform efforts, especially combining Instagram, TikTok, and YouTube, tend to yield the strongest outcomes.

Emerging Trends for 2025

This year, authenticity is everything. There’s a rise in “DE-influence,” where people prefer everyday user reviews (77% in some surveys) over hype from big names. Micro and nano-creators are thriving because they feel more genuine.

Challenges include platform changes and crowded spaces, but opportunities abound in social commerce and experiential campaigns. Sustainability and cultural relevance are big focuses as consumers demand more meaningful connections.

Conclusion

To sum up, Mexico’s influencer marketing landscape in 2025 is characterised by strong growth, genuine trust, and meaningful audience engagement. With high follow rates, strong purchase influence, and a clear shift toward smaller, more authentic creators, it offers an ideal environment for brands to build lasting connections with consumers.

The key? Prioritise data-backed choices, cultural fit, and measurable results. Agencies like Brand Me or The Influencer Marketing Factory can help navigate this dynamic landscape.

Looking ahead, as part of Latin America’s second-largest market, Mexico continues to innovate in mobile-first, youth-driven ways. Brands that embrace these insights will likely see the best returns