G’day, if you’re running a brand down under or just curious about how social media is changing the game, influencer marketing in Australia is absolutely booming right now. Picture this: in 2025, brands are splashing out around AID 929 million on influencer campaigns, that’s up a fair bit from last year, showing how Aussies are ditching traditional ads for something more real and relatable. Why? Because with everyone scrolling through their feeds, influencers cut through the noise like nothing else, building trust and driving sales in ways billboards just can’t. And let’s face it, with social media users hitting 20 million and climbing, brands can’t afford to ignore it.

This article’s your go-to for the freshest Australia brand influencer marketing statistics 2025, packed with hard numbers on everything from market growth to what platforms are winning and how consumers are responding. We’ll break down budgets, hot industries, and even some regional quirks to help you make smarter calls. Whether you’re a small business in Perth or a big player in Sydney, these insights are gold for tweaking your strategy. Stick with me, and by the end, you’ll see why jumping on this trend could be your best move yet.

Australian Influencer Marketing Market Size & Forecast 2025–2030

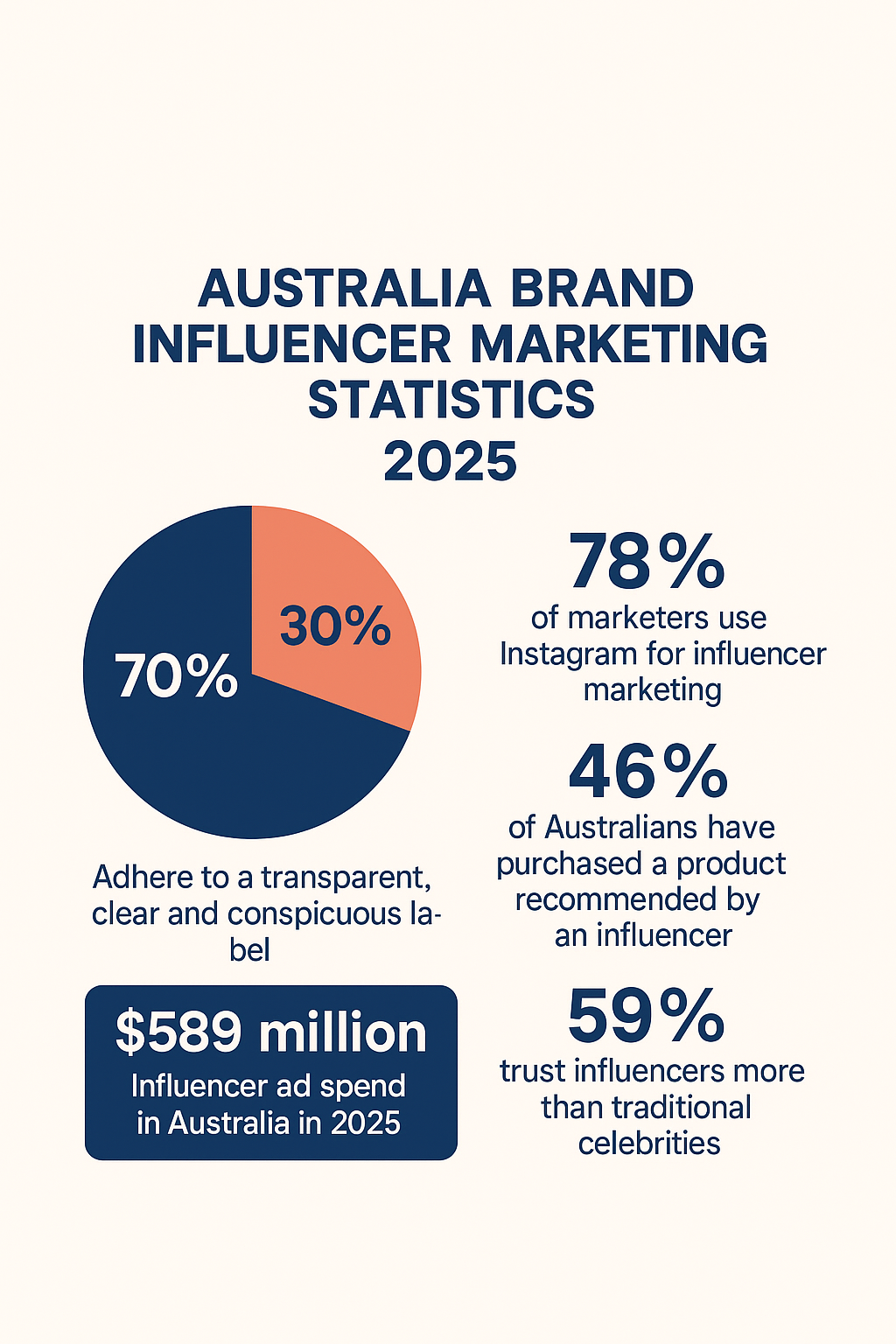

The market’s looking pretty healthy this year. In 2025, total ad spend on influencers is pegged at about US$589 million, which convert around AID$929 million. That’s a solid jump from the US$520 million we saw in early reports, showing things are picking up steam. Year-on-year growth sits at around 11-13%, depending on who you ask, which is impressive considering the broader ad landscape.

Looking further out, the compound annual growth rate (CAGE) is forecast at 11%, pushing the market to over US$800 million (AID$1.257 billion) by 2028. By 2030, social commerce tied to influencers could be even higher, with revenues potentially topping US$10 billion if trends hold—though estimates vary. Compared to 2024, that’s a 13% bump in spend alone, and in the APACE region, Australia ranks strongly, trailing behind bigger players like China but leading in per-user engagement. If you’re planning, this growth means more competition, but also bigger opportunities for targeted campaigns.

Top Platforms Dominating Australia in 2025

When it comes to where the action is, Instagram’s still the king, with 78% of Aussie marketers saying it’s the most effective for influencer collars. Ticktock’s hot on its heels, especially for short-form stuff, and 89% of marketers reckon their ROIL there matches or beats other channels. YouTube grabs about 56% for video content, while Facebook is preferred by 88% of folks overall, making it great for broader reach.

Ticktock’s the fastest grower, with Aussies spending nearly 39 hours a month on it—perfect for Gen Z, where 51% of 18-29-year-olds research there. Millennials (30-44) lean more to Facebook at 38%. LinkedIn’s niche for BOB, and Interest pops for visuals like fashion. If your crowd’s young and fun, Ticktock’s your pick; for lasting impact, mix in YouTube.

Influencer Tier Breakdown & 2025 Pricing

Influencers aren’t all the same, and in Australia, smaller ones are stealing the show. Nano-influencers (1-10K followers) make up 78% on Instagram and 55% on TikTok, snagging over 53% of brand deals thanks to their sky-high engagement—12.6% on average. Micro (10K-100K), with strong ROIL from authentic vibes.

Pricing keeps it accessible: Nano folks charge AID$3 to $393 per post or reel, while micro hit AID$39 to $1,965. Macro and celebs take a smaller slice, about 20-30% of campaigns, but cost more for big reach. Budget share? Na nos get the bulk because they’re cost-effective—brands love that niche trust without breaking the bank.

Most Active Industries in Australia

Some sectors are going all-in on influencers. Beauty chats are racking up high engagement on TikTok. Health and wellness follow, especially post-pandemic, then travel with its wanderlust reels. Finance is picking up for tips and advice, food and beverage for yummy reviews, and tech for unboxing.

Lifestyle’s the top category at 16.4%, with music and beauty at 8% and 5%. Highest Roach? Beauty and fashion, where authenticity drives buys—think 3% engagement on food posts. If you’re in these, an influencer can supercharge your visibility.

Check out the United State (USA) influencer marketing stats for 2025 here

Budget Allocation & Campaign Costs

Brands are carving out more room for influencers, with about 26% globally allocating over 40% of digital budgets—Australia is following suit. Average campaign spends range from AID$10K for small ones to over $500 for big pushes. Per internet user, it’s about AID$35 in ad spend.

Always-on ambassador programs are, with 58%. Costs per post vary by tier, but discounts for long-term deals (71% of influencers offer them) make it smarter. Overall, influencers now eat up 3.6% of the digital ad pie, up 5.3%.

Consumer Trust & Engagement Statistics

Aussies are savvy, but 59% trust influencers more than celebs for revs. Transparency’s key—44% say it’s crucial, and 36% base trust on past solid tips. Purchase intent? 46% have bought after seeing a promo, and 86% make an influencer-inspired.

Engagement benchmarks: Nano at 12.6%, sponsored content 90% better than organic. Ticktock’s 3% for food, Instagram 1.59% for fashion. Gen Z engages 27% on TikTok, older folks on Instagram. Authenticity drives it all.

Regional Insights: Sydney/Melbourne vs Regional Australia

Campaigns cluster in big cities—Sydney and Melbourne host about 60%, to urban crowds and creator hubs. But regional Australia’s growing, with more campaigns targeting rural vibes and Indigenous creators bringing unique stories.

Indigenous influencers are on the rise, boosting diversity in wellness and travel niches. Tier-2 spots like Brisbane see higher engagement from local ties. For brands, blending metro reach with regional authenticity pays off.

Emerging Trends 2025–2026

Short-form video is huge, with TikTok Shop adoption skyrocketing—86% of brands say video beats static. Virtual influencers and AI tools are emerging, helping match creators (60% use AI). Sustainability’s big, with values-based partnerships—brands want creators who align on Eco stuff.

By 2026, expect more micro-focus and social commerce integration. For a quick dive, check this YouTube video: Influencer Majoinhealthcare. Marketing in 2025: What Creators & Brands Need to Know

Regulations & KANA / Ad Standards Update 2025

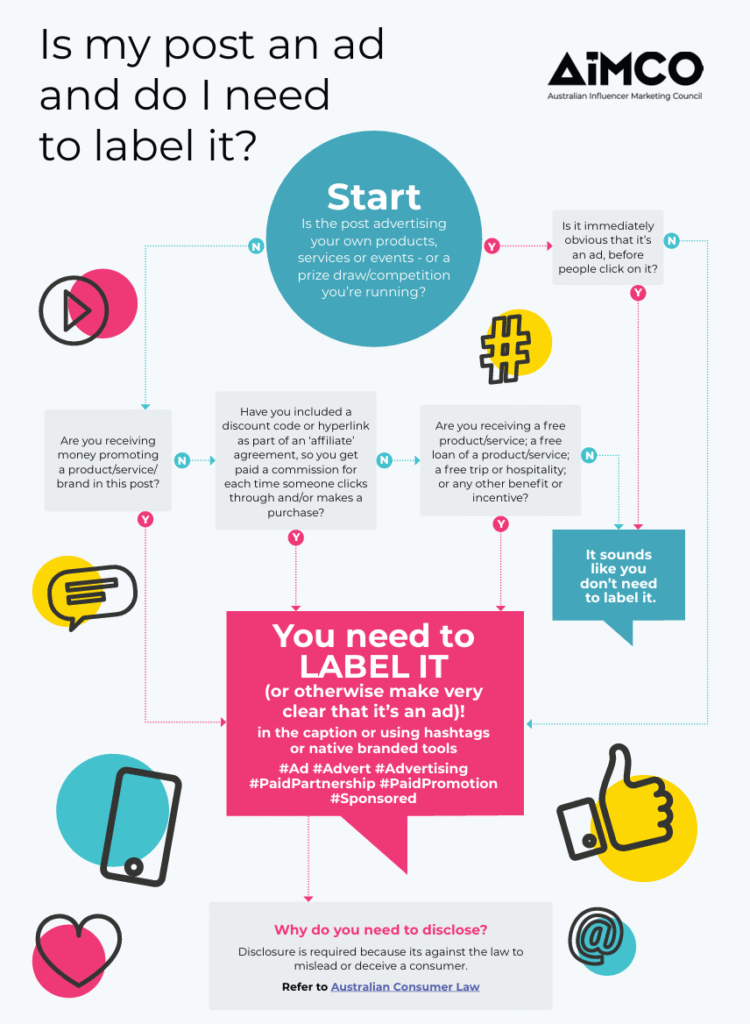

Rules are strict to keep things fair. Under the SANA Code of Ethics, influencers must disclose with #ad or #sponsored—compliance is high, but 81% of high-profile influencers have slipped up. Ad Standards upheld complaints in 2025, like a June case on non-disclosure.

New bits around health, finance, and alcohol: No misleading claims, per ACCT. Aramco’s code helps with ethics. Stay on top to avoid fines.

Conclusion + 6 Actionable Takeaways for Australian Brands

Wrapping it up, Australia brand influencer marketing statistics 2025 show a thriving scene with AUDRA spend, 11% growth, and huge trust potential. It’s all about real connections in a digital world.

Takeaways: 1. Budget 20-40% for influencers. 2. Prioritise nano/micro for engagement. 3. Mix platforms—TikTok for youth, Insta for all. 4. Focus on transparency for trust. 5. Explore regional creators. 6. Embrace AI and sustainability trends.

For more basics, check Influencer marketing on Wikipedia.

FAQ Section

What is Australia’s influencer marketing spend in 2025?

Around AUD$929 million, up 11% from 2024.

Which platform delivers the highest ROIL for Aussie brands?

Instagram for effectiveness (78%), TikTok for comparable ROIL (89%).

How much do Australian micro-influencers charge in 2025?

Typically, AID to $1,965 per post.

Is Ticktock overtaking Instagram in Australia this year?

Yes, fastest-growing with high engagement, but Instagram still leads overall.