Hey there, if you’re diving into the world of digital marketing, you’ve probably noticed how influencer partnerships have become a game-changer for brands. It’s not just about flashy ads anymore; it’s about real connections that drive sales and loyalty. In this piece, we’re zeroing in on two powerhouse markets: Brazil and South Korea. Both are buzzing with activity in influencer marketing, but they bring different flavours to the table. Brazil’s got that massive, energetic vibe, while South Korea shines with its polished, trust-driven approach. We’ll break down the key statistics for 2025, compare them head-to-head, and share some insights on what this means for your brand strategy. Think of this as your quick guide to deciding where to focus your efforts – or maybe even both!

By the way, if you’re new to this, check out the Wikipedia page on influencer marketing for a solid foundation. It’s a great starting point to understand how influencers shape consumer behaviour.

Global Influencer Marketing Context 2025

Let’s set the stage with the bigger picture. The influencer marketing industry worldwide is exploding, and 2025 is no exception. Experts project the global market to hit around $32.55 billion this year, marking a hefty jump from previous figures. That’s a growth rate of about 35.6% from 2024, showing just how much brands are betting on this channel. Why the surge? Well, consumers are tired of traditional ads; they want recommendations from people they follow and admire. In fact, a whopping 86% of marketers are incorporating influencer strategies into their plans in 2025.

What’s furling this? Rising emphasis on measurable returns, the boom in short-form video content, and a shift toward smaller, more relatable influencers. Platforms like Instagram and TikTok are leading the charge, but we’re also seeing innovations like AI-driven matching and live shopping events. Brands aren’t just throwing money around – 80% have either kept or boosted their budgets this year, with nearly half increasing by 11% or more. It’s clear: influencer marketing isn’t a fad; it’s a staple for engaging audiences in a crowded digital space.

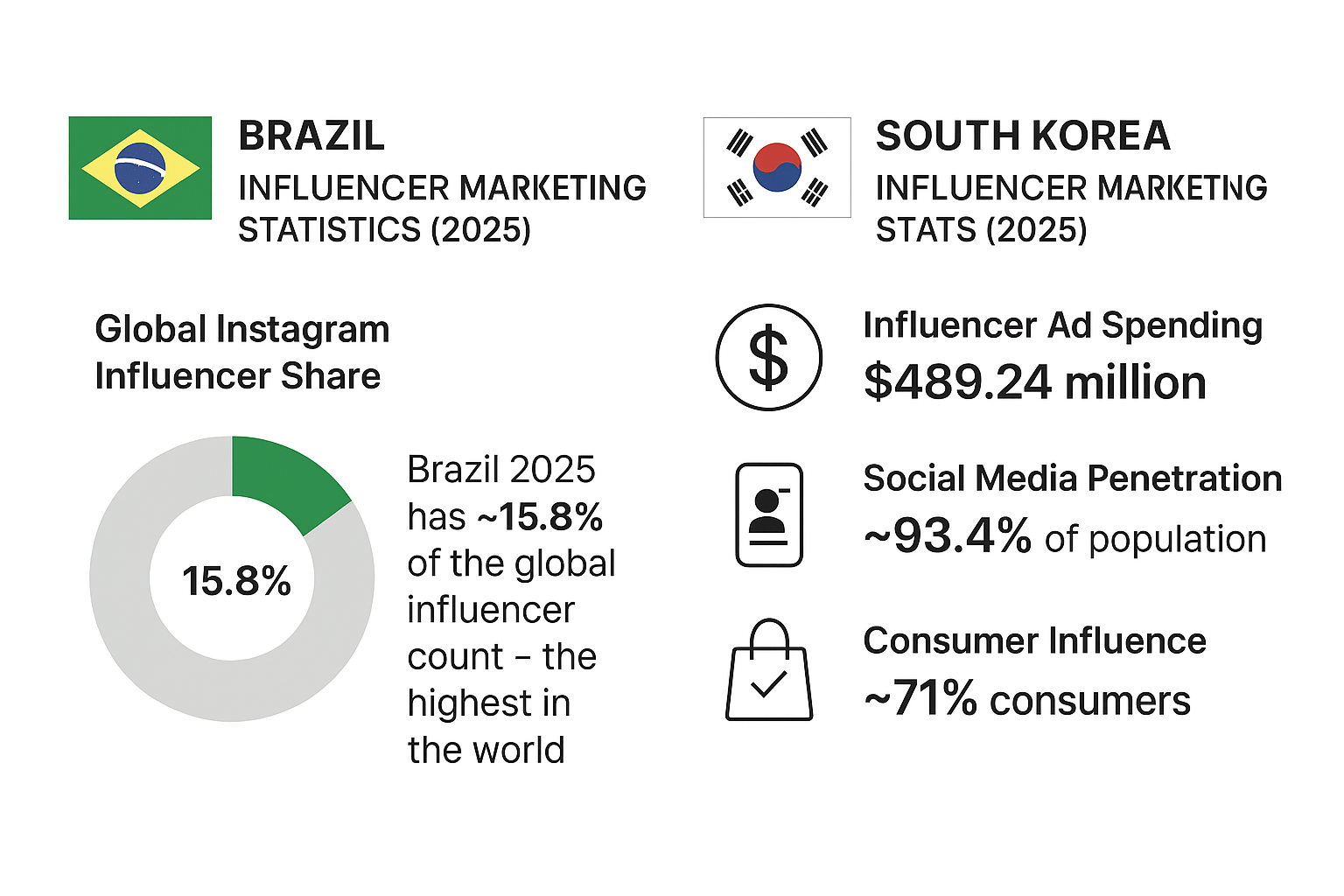

Influencer Marketing Statistics in Brazil 2025

Now, let’s zoom in on Brazil. This country is a hotspot for brand influencer collaborations, thanks to its vibrant social scene and huge online population. In 2025, ad spending on influencer marketing here is expected to top half a billion US dollars, continuing a double-digit growth streak. That’s impressive, right? Brazil now boasts the highest number of Instagram influencers globally, with about 3.83 million creators making up 15.8% of the platform’s total. They’ve even edged out the US in this department.

Consumer engagement is off the charts, too. Nearly all internet users in Brazil – we’re talking 97% – interact with influencer content regularly. This high involvement translates to strong brand reach, especially on Instagram, which dominates the scene. But don’t sleep on TikTok; it’s growing fast, with brands using it for viral challenges and quick-hit promotions. Sponsored posts from Brazil account for around 14.5% of the global share, making it a volume leader.

For brands, this means opportunities in scale. Whether you’re in fashion, beauty, or tech, partnering with macro-influencers or celebrities can amplify your message to millions. Just imagine a campaign going viral in a market where social media is practically a daily ritual. However, with so much content out there, standing out requires creativity and authenticity to avoid getting lost in the noise.

Influencer Marketing Statistics in South Korea 2025

Shifting gears to South Korea, the landscape here is more about precision and trust than sheer volume. In 2025, influencer ad spending is forecast to reach approximately $489 million, with projections to nearly double by 2030. That’s solid growth in a country where social media penetration hovers around 93-94%, one of the highest rates worldwide.

What sets South Korea apart? Consumers here are 71% more likely to buy based on social media endorsements, especially in sectors like fashion and beauty. The average conversion rate from influencer campaigns sits at 5.2%, higher than many neighbours like Japan. Platforms play a big role: Instagram and YouTube are popular, but local favourites like Aver add a unique twist with integrated search and community features.

Micro and nano-influencers rule in South Korea, as audiences crave genuine connections over celebrity hype. This focus on authenticity boosts purchase influence – think K-beauty tutorials or fashion hauls that feel like advice from a friend. The influencer platform market alone is valued at $291.4 million this year, set to skyrocket to over $1.2 billion by 2032. For brands eyeing Asia, South Korea offers targeted, high-ROI opportunities, especially if you’re tapping into K-culture’s global appeal.

If you want a visual deep dive, here’s a helpful YouTube video on the state of influencer marketing in 2025: The State of Influencer Marketing 2025. It breaks down trends with real examples that might spark some ideas for your own campaigns.

Brazil vs South Korea: Key Comparisons

So, how do these two stack up? Let’s compare the nuts and bolts. In terms of market size, Brazil’s influencer ad spend edges out South Korea’s – over $500 million versus $489 million in 2025. But growth rates tell a different story; South Korea’s market is poised for faster expansion in the long term.

Volume-wise, Brazil wins hands down with its army of influencers and 15.8% share of global Instagram posts. Sponsored content floods the feeds here, perfect for broad awareness campaigns. South Korea, on the other hand, excels in conversion – that 5.2% rate means more bang for your buck when it comes to actual sales.

Influencer types differ too: Brazil leans on macro and celebrity figures for mass appeal, while South Korea favours micro-influencers for that trusted, niche touch. Platforms overlap with Instagram, leading both, but TikTok surges in Brazil, and YouTube plus Aver give South Korea an edge in video and local search. Consumer trust? South Koreans edge it out, with higher purchase intent from authentic endorsements.

Opportunities abound: Brands chasing scale might flock to Brazil, while those prioritising precision and loyalty could thrive in South Korea. It’s not an either-or; many global players mix strategies across both for diversified reach.

Check out the United State (USA) influencer marketing stats for 2025 here

| Aspect | Brazil | South Korea |

|---|---|---|

| Ad Spend 2025 | >$500M | ~$489M |

| Influencer Count (Instagram) | 3.83M (15.8% global) | Lower volume, focus on quality |

| Conversion Rate | High engagement, variable | 5.2% average |

| Top Platforms | Instagram, TikTok | Instagram, YouTube, Aver |

| Key Strength | Scale & Volume | Authenticity & Trust |

This table sums it up neatly – pick based on your goals.

Emerging Trends for Brands in 2025

Looking ahead, what should brands watch? Authenticity is king; consumers can spot fakes a mile away, so long-term partnerships are on the rise. AI tools are helping match influencers with brands more efficiently, and live commerce – think shopping streams – is exploding, especially in South Korea’s tech-savvy market.

Micro-influencers are gaining ground everywhere, offering better ROI than big names. In Brazil, expect more cross-border campaigns leveraging Latin America’s growth, while South Korea pushes the K-wave globally. Challenges? Measuring true ROI remains tricky, and avoiding authenticity scandals is crucial. Brands need smart analytics to track engagement beyond likes.

Overall, both markets are adapting to these shifts, making 2025 a pivotal year for innovative strategies.

Conclusion

Wrapping this up, Brazil and South Korea offer distinct paths in brand influencer marketing for 2025. Brazil’s your go-to for massive reach and energetic campaigns, while South Korea delivers on trust and conversions. Depending on your target audience – broad Latin vibes or precise Asian appeal – tailor your approach accordingly. The future looks bright, with continued growth projected across the board.

If you’re a brand manager or marketer, now’s the time to experiment. Dive in, test partnerships, and measure what works. Who knows? Your next big hit could come from a clever influencer tie-up in one of these dynamic spots.

Sources and Further Reading

For the data here, I drew from reliable spots like Statista, Influencer Marketing Hub, and industry reports. Check them out for deeper dives: