Hey everyone, if you’re involved in marketing or running a brand in Indonesia, you’ve probably noticed how influencers are everywhere these days—from beauty tutorials on TikTok to food reviews on Instagram. It’s not just hype; with over 143 million social media users spending more than three hours a day scrolling, influencers have become a go-to way for brands to connect genuinely with people. In 2025, this space is growing rapidly, driven by young, mobile-savvy folks who trust creators more than traditional ads.

This article compiles the latest Indonesia brand influencer marketing statistics for 2025, covering market numbers, top platforms, consumer trends, and what’s next. Whether you’re planning campaigns in Jakarta or targeting regional audiences, these insights can help you navigate more effectively. Let’s get into it and see how this dynamic market is shaping up this year.

Indonesia Influencer Marketing Market Size & Forecast 2025–2030

Things are looking strong for influencer marketing here. In 2025, ad spend is expected to reach around US$257 million, marking a notable increase compared to 2024’s figures. That’s roughly IDR 4 trillion, depending on exchange rates. Year-over-year growth remains steady at around 10%, driven by the broader expansion of digital advertising.

Looking ahead, the CAGR is projected at around 10% through 2029, potentially reaching US$380–410 million by 2030. Compared with the lower ad spend in 2024, this growth reflects the rapid rise of social commerce and e-commerce integrations.

In Southeast Asia, Indonesia leads in user engagement, ranking among the top in the region, just behind larger economies such as China. With increasing internet penetration and a large, young population, this expansion is closely linked to more brands shifting their budgets to Indonesia to achieve more authentic and effective reach.

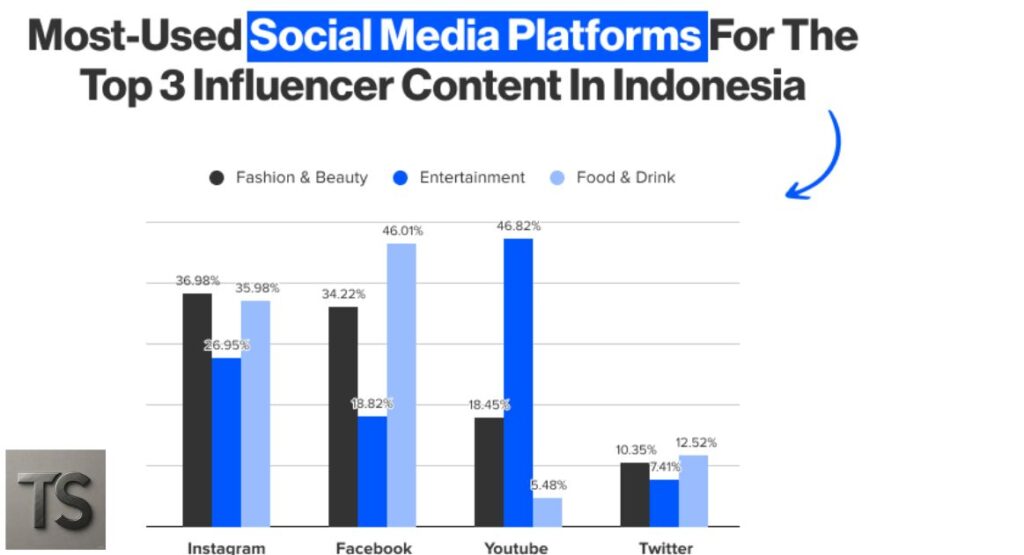

Top Platforms Dominating Indonesia in 2025

Platforms play a huge role, and variety is key in this diverse market. Instagram tops the list for visual content like reels and stories, with massive usage among marketers. TikTok is exploding for short videos, driving viral trends and quick discoveries—it’s the fastest-growing for younger crowds.

YouTube holds strong for in-depth reviews and tutorials, while Whats App and Facebook round out everyday chats and broader shares. TikTok and Instagram together dominate influencer collars, especially with TikTok Shop integrating shopping seamlessly. For niches, gaming leans YouTube, beauty Instagram. If targeting Gen Z, prioritise TikTok; for wider families, mix in Facebook.

Influencer Tier Breakdown & Pricing Insights

Not all creators are equal, and smaller ones often pack the biggest punch here. Nano-influencers (under 10K followers) dominate, making up a huge chunk like 75% in some reports, with super high engagement rates. Micro (10K-100K) follow, offering great authenticity.

Pricing stays affordable: Nano around $20-500 per post, micro higher but still value-driven compared to global. Macro and celebs cost more for reach but less for trust-building. In 2025, brands favourite nano and micro for cost-effective, real connections—perfect for niche or regional pushes.

Most Active Industries & Niches

Certain sectors love influencers the most. Fashion and beauty lead, with tutorials and hauls everywhere on Instagram and TikTok. Food and beverage follows for tasty reviews, then e-commerce for direct sales, entertainment for fun tie-ins, and gaming for streams.

Local culture shines in these, like hijab fashion or regional foods. Rise in skincare and personal care ties to live demos. Brands in these see strong conversions from relatable content.

Budget Allocation & Campaign Costs 2025

Budgets are tilting digital, with influencers claiming a solid slice—many brands allocating more as ROIL proves out. Average campaigns vary: small ones affordable for nano, larger with performance ties.

Performance-based and affiliate models are growing, rewarding sales directly. In 2025, expect shifts toward always-on partnerships over one-offs for sustained buzz.

Check out the United State (USA) influencer marketing stats for 2025 here

Consumer Trust & Engagement Statistics

Trust is massive—76% of users follow at least one influencer, and 68% have bought based on recommendations. Many prefer creator tips over brand posts for authenticity.

Engagement shines with nano, higher rates building real loyalty. In 2025, repeated exposure from trusted voices drives decisions, especially among youth.

Regional & Local Language Insights

Indonesia’s spread out, so regional matters. Java centres much activity, but outer islands grow fast with vernacular content. Bahasa Indonesia dominates, but dialects in Tamil, Javanese boosts engagement in non-Java areas.

Tier-2/3 cities surge, where local creators connect deeper. Brands blending national with regional languages win bigger.

Emerging Trends for 2025–2026

Short-form video rules, with live commerce on TikTok Shop booming—think real-time sales and demos. AI tools help matching, virtual influencers emerge slowly.

Affiliate partnerships rise, sustainability focuses appeal to conscious buyers. By 2026, more AR try-nos and community builds.

Check this YouTube video for more: TikTok Shop Strategies for Brands in Indonesia 2025

Regulations & Compliance Update 2025

Transparency’s key—disclosures like #ad are pushed, though not fully mandated yet. OIK eyes influencer for finance claims. Challenges include fake engagement, so vetting matters.

Platforms guide branded content. Stay ethical to build lasting trust.

Conclusion + 7 Actionable Takeaways for Indonesian Brands

Overall, Indonesia brand influencer marketing statistics 2025 show a vibrant $257 market with 10% growth, TikTok/Instagram leading, and huge consumer trust at 68-76% purchase influence.

Takeaways: 1. Mix nano/micro for engagement. 2. Leverage TikTok Shop lives. 3. Go vernacular for regions. 4. Use performance pays. 5. Focus beauty/fashion niches. 6. Ensure disclosures. 7. Blend short-video trends.

For basics, see Influencer marketing on Wikipedia.

FAQ Section

What is Indonesia’s influencer marketing spend in 2025?

Around US$257 million.

Which platform dominates influencer ROI in Indonesia?

TikTok for vitality, Instagram for visuals.

How much do Indonesian micro-influencers charge in 2025?

Varies, often affordable compared to global.

Is TikTok Shop changing influencer strategies in Indonesia?

Yes, boosting live commerce hugely.